SEO

Free SEO Analysis

SEO Services

Content Marketing Services

Local SEO

Link Building Services

Specialized SEO Services

PPC

REPUTATION MANAGEMENT

Free Reputation Management Analysis

Reputation Management Services

Review Management Services

Specialized Reputation Management Services

CEO Reputation Management

Brand Enhancement

Business and Directory Listings

Comprehensive Reputation Management Audit

SOCIAL MEDIA

Free Social Media Analysis

Specialized Social Services

WEB DEVELOPMENT

Free Website Analysis

Web Design Services

Mobile Development Services

Website Maintenance Services

Specialized Development Services

MARKETING AUTOMATION

Free Marketing Automation Analysis

Specialized Marketing Automation Services

Comprehensive Marketing Automation

INDUSTRIES

ABOUT DMA

WHITEPAPER

The Future Fortunes of the Financial Services Sector are Online

10th June 2022

Executive Summary

71% of financial services organizations are planning to increase their digital marketing spend

When consumers go online to find and research service providers, they often focus on local searches.

Producing ample, helpful content can genuinely help with search ranking and attracting visitors

If you want to reach tomorrow's customers today, it's past time to go for broke with your online marketing plans.

Financial services – which includes banks and credit unions, lenders, financial advisors, investment firms, and more – is an age-old industry that must always keep its eye on the future.

Today, more and more consumers seek financial services online, and if companies looking to capture the next generation of customers don't show up for online searches, they might as well be invisible. Analysts at Deloitte studied different groups of investors, for example, and found that two-thirds (64%) of "up-and-comers" (the next generation of investor) use web and mobile channels heavily to research advisors.[i] Millennials in particular prefer to research wealth management online.

This appears to be a robust finding. Industry consultancy Accenture found nearly the same numbers in a similar study of people seeking financial management information and advice online. They also found that nearly two-thirds (60%) of the largest group they studied, which they call "Nomads," use online services like Google to find information to support investment decisions.[ii] Nomads aren't alone in this; Accenture calls the next largest group of investors "Quality Seekers." This group prefers to get advice directly from advisors, but only 20% describe their advisor's online site and tools as their most useful source of advice.[iii]

In short, as people conduct financial research, seek wealth management advice, and try to find a variety of financial services, they are doing so online in massive numbers. If you want to reach these consumers, you must show up when they search online!

So, it’s no wonder that fully 71% of financial services organizations are planning to increase their digital marketing spend.[iv] After all, for savvy advisors and financial institutions, this situation presents a lot of opportunity for competitive differentiation.

But how?

That's the million-dollar question. How do you get your website to the top of the Google search engine results page? How do you differentiate yourself and your site? How do you reach these valuable customers? Those are the questions this paper will address.

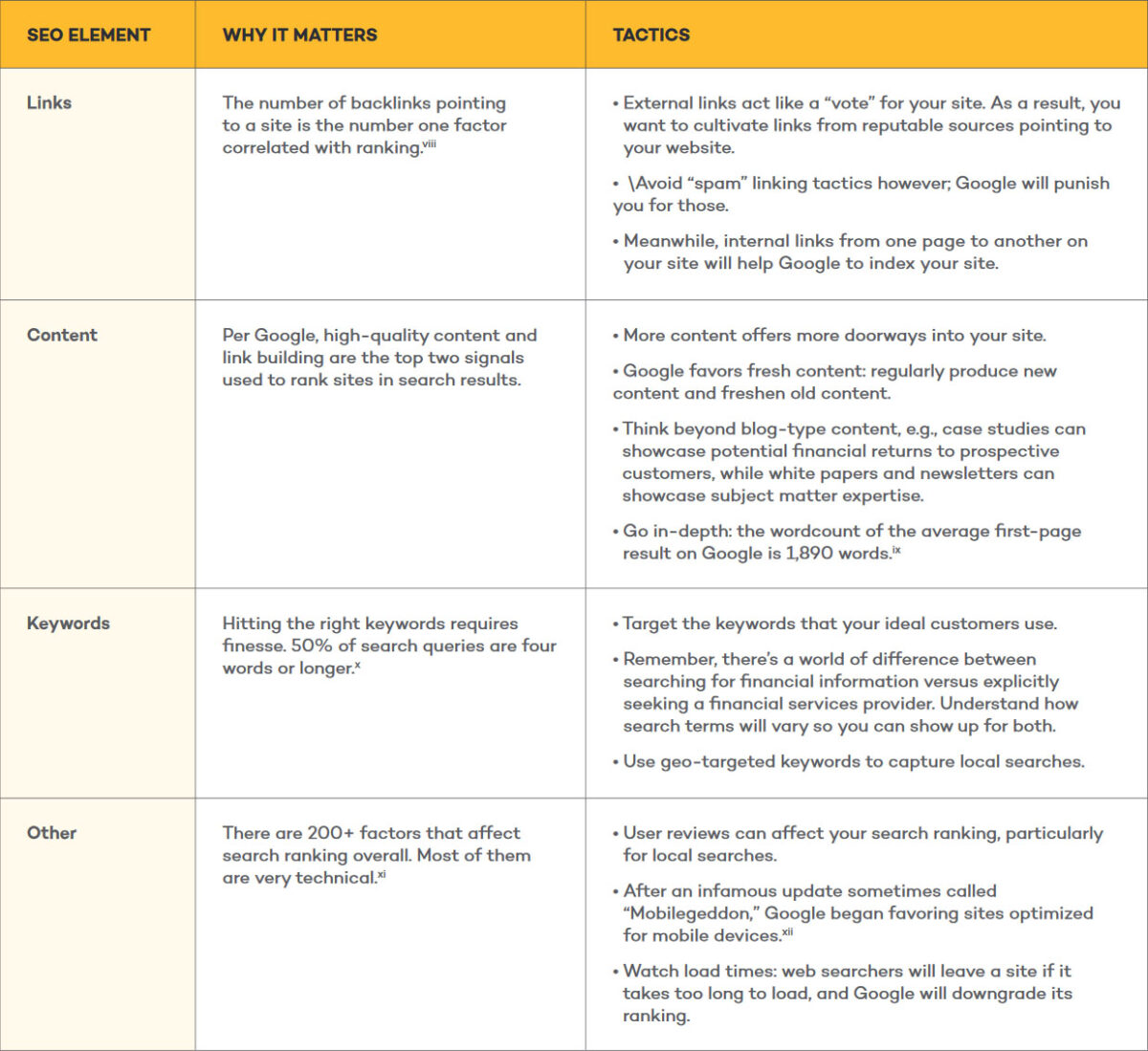

Start with Search Engine Optimization

Search engine optimization (SEO) refers to the process of making sure your website appears when a consumer uses a search engine like Google to look for financial information or services. But it’s not enough just to show up somewhere in the results; you must show up on the first page, given that 75% of Google users never click past the first page.[v] But if you can successfully show up there, you can garner the lion’s share of search traffic. If you appear in the first position of Google search results, you’ll enjoy a fantastic 33% clickthrough rate.[vi] However, SEO is a multi-layered effort, with literally hundreds of separate factors that affect how highly your website will rank in search results. Worse, Google's algorithm for determining ranking is sophisticated, complex, and always evolving; Google changes it 500 to 600 times every year).[vii] See the table below for the most important factors affecting search ranking.

Don't Neglect Local SEO

When consumers go online to find and research service providers, they often focus on local searches. Four out of five consumers use search engines to find local service providers, in fact.[viii]

That means they're looking for providers located nearby. They'll usually add a geo-targeted keyword to their online search, e.g., instead of searching for just a generic "financial advisor" they'll look for "financial advisor in Tallahassee, FL."

That’s true regardless of whether they’re searching for digital-only services or face-to-face time. Even the latter group will still use Google and other online resources to find you in the first place, so you still need to show up for local searches.

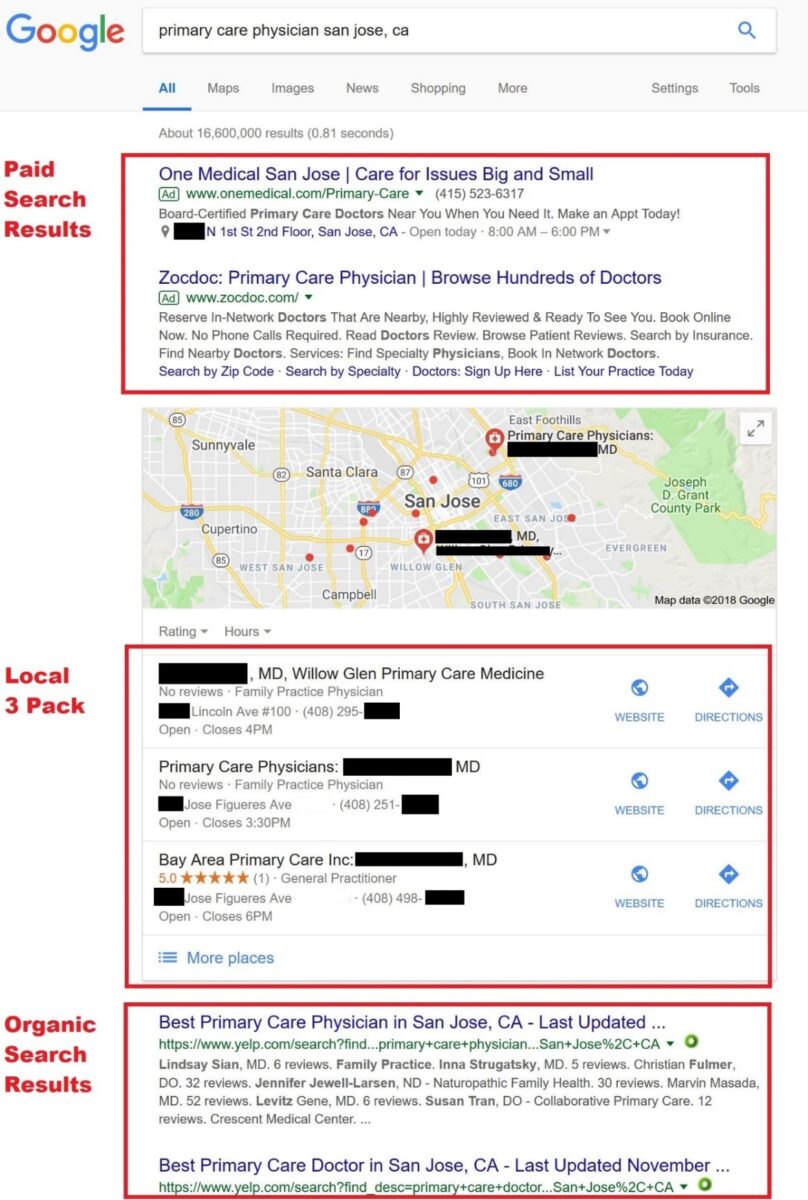

Unfortunately, search ranking for local searches versus nationwide or worldwide searches is a little different, and just because you rank well for one doesn't necessarily mean you'll also show up for the other. The search listings also appear a little differently. Local searches include something called the "Local 3 Pack" that include additional details and appear above the primary search results (see figure). This is prime real estate, and you want to maximize your chances of appearing here.

Thankfully, local SEO is no more difficult than normal SEO, and many of the same tips listed above still apply. Just remember to:

Set up your "Google My Business" local listing. This refers to a business profile listed with Google that can showcase more detailed information about your business when customers perform searches. In fact, factors related to your “Google My Business” listing accounts for 25.12% of whether or not your business will appear in the Local 3 Pack.

Manage online reviews, especially with Google, as well as with other appropriate sites (like Yelp). We'll discuss reviews in more detail in Section #4 below.

Incorporate geographic indicators into your keywords and content on your website (e.g., financial services Chicago, IL).

Populate your website with good content relevant to local users and keep producing content over time. We’ll discuss this advice further in the next section.

Go Big With Content Marketing, but be Careful to Meet Google's Standards

Content is a major factor in search rankings. Remember, Google's goal is to connect web searchers with the exact kind of service or information they are seeking. It uses the content on your site – which can include not just text but also images, video, audio, embedded media, and more – to judge whether your site is going to give the web searcher what he or she wants. Since so many consumers of financial services are specifically looking for high quality financial information and advice, useful, informative, up-to-date content becomes even more important in this sector.

Indeed, Google says so itself. Specifically, Google has special guidelines that govern content that falls into the "Your Money, Your Life" (YMYL) category.[x] Financial services organizations would be included in this category, and Google demands higher quality of YMYL content than average: “We have a very high Page Quality rating standards for YMYL pages because low quality YMYL pages could potentially negatively impact users’ happiness, health, or financial stability.”

Further, Google effectively doubled-down on this requirement with a massive update in August 2018 sometimes called the "Google Medic" update, which primarily affected YMYL sites. Google wants to connect users to reputable sites that provide content that fits the E-A-T paradigm (Expert, Authoritative, Trustworthy). The update was designed to punish sites that failed to provide such content, or that used the content to try to deceive or manipulate users. As a result, it's key for financial services providers to pay closer attention to content production than average. Now for the good news: producing ample, helpful content can genuinely help with search ranking and attracting visitors. For example, having a blog increase your chances of ranking on search engines by 434%.[xi]

Manage Online Reviews

If you want your business to have an online presence, pay attention to online reviews.

First, they make a difference in search engine rankings, especially if you want to show up in the Local 3 Pack. Reviews account for 6.47% of the factors affecting normal search ranking and 15.44% for the Local 3 Pack.[xii] At those numbers, you cannot afford to overlook online reviews and still expect to rank highly with Google and other search engines.

Second, reviews are vital not just to search engines but also for consumers researching potential services. People rely on them, in fact: "online reviewers have overtaken friends, family and colleagues as the most trusted source of product information."[xiii]

In other words, in many ways, reviews are the new referrals. However, there's a major caveat here: financial services organizations are governed regulations that strongly impact how customer reviews and testimonials can be solicited and used (see the sidebar, which presents a relevant excerpt from the Investment Advisers Act). That means, unlike other industries, financial advisors and other operators in this space must pay very close attention to compliance concerns when managing their online reviews. In general, the key is to avoid any practice that could be considered "fraudulent, deceptive, or manipulative."[xiv]

Conclusion

The new normal in financial services is digital: success in this domain, today and into the future, depends on finding success online. Thankfully, achieving dominance with Google and other search engines doesn’t require financial organizations to break they bank. They simply need to know what they’re doing and ensure they follow the right steps to show up at the top of the pack when prospective customers look for them online.

That said, it is important to keep compliance requirements in mind. Both the federal government and Google itself have issued strict guidelines to financial services providers that affect what they can do online, and how they need to do it. But if you can meet these requirements and follow the steps outlined in the paper, you will be equipped to thrive as the online space grows and new fortunes are made. You can bank on it.

[i] https://www2.deloitte.com/content/dam/Deloitte/us/Documents/strategy/us-cons-retooling-wealth-management-for-the-digital-age.pdf

[iii] https://www.accenture.com/us-en/insight-investment-advice-distribution-marketing-consumer-study

[iv] https://adobe.ly/2NJIJIT

[v] https://www.searchenginepeople.com/blog/40-unbelievable-seo-statistics-need-know.html#note-68961-20

[vi] https://searchenginewatch.com/sew/study/2276184/no-1-position-in-google-gets-33-of-search-traffic-study

[vii] https://moz.com/google-algorithm-change

[viii] https://www.thinkwithgoogle.com/advertising-channels/search/how-advertisers-can-extend-their-relevance-with-search/

[ix] https://moz.com/local-search-ranking-factors

[x] https://static.googleusercontent.com/media/www.google.com/en/insidesearch/howsearchworks/assets/searchqualityevaluatorguidelines.pdf

[xi] https://blog.hubspot.com/customers/10-reasons-blogging-should-be-part-of-your-2018-content-strategy

[xii] https://moz.com/local-search-ranking-factors

[xiii] https://www.emarketer.com/Article/Consumer-Trust-Evolving-Digital-Age/1014959

[xiv] https://www.sec.gov/investment/im-guidance-2014-04.pdf

Our Sales team